In the insurance industry, the “traditional” system for handling claims is still highly manual, time-consuming and error-prone, leading to delays in payment and higher administration costs. There is therefore a potential for optimization and cost reduction that can be realized through Generative AI. To achieve this, LLMs need to be able to reason about the documents associated with the business process. This includes not only the contract, but also warranty tables, procedure flowcharts, appendix, exemptions, and so on. However, in this exercise, LLMs are faced with a limitation that is associated with their context window.

What is a context window?

The context window is a sophisticated method for defining how many words a large language model can handle simultaneously. It plays a crucial role in natural language content processing. By adjusting the size of the window, we can determine the model’s ability to grasp the context of a question, thus improving its ability to provide relevant and appropriate answers. This ability to understand the context of a query is crucial to guarantee accurate results from an LLM in the context of a business process involving complex documents such as insurance contracts.

Why is this important?

Context windows limit the LLM’s maximum processing size, often including the expected response, which poses a major challenge when analyzing large datasets such as reports or contracts of several dozen pages. Indeed, when the context becomes too vast, LLM performance decreases significantly: the more words the model processes, the less satisfactory the results, as the necessary fragmentation of processing, page by page, restricts the model’s overview of the corpus. This limits his ability to understand all the information he is given. To overcome this shortcoming, the RAG (Retrieval Augmented Generation) architecture pre-selects relevant elements from the corpus, enabling the LLM to process them together for a global understanding of the context. In summary, the RAG approach improves the analysis of complex data by partially overcoming the constraint of context windows.

RAG limits

However, RAG is not a complete solution, especially for professional situations. This RAG approach simply bypasses the context limit, but does not include any professional notion. It creates a new limitation: to read and reason about a sophisticated business document of several dozen pages, such as an insurance contract, it is necessary to apply a reading mode corresponding to the business. In other words, to interpret the different parts of the document according to their importance and order in the business logic. For example, the general conditions of a contract may be contradicted by clauses in the special conditions. For example, contract amendments may include new clauses that call on third-party documents (a warranty table, a technical procedure, etc.). So, to produce compliant results, the RAG needs to be “piloted” by a chain of software commands telling it at what point in the process and on what the LLM should reason, so as to stay within the business logic.

LLM generalists and the insurance contract

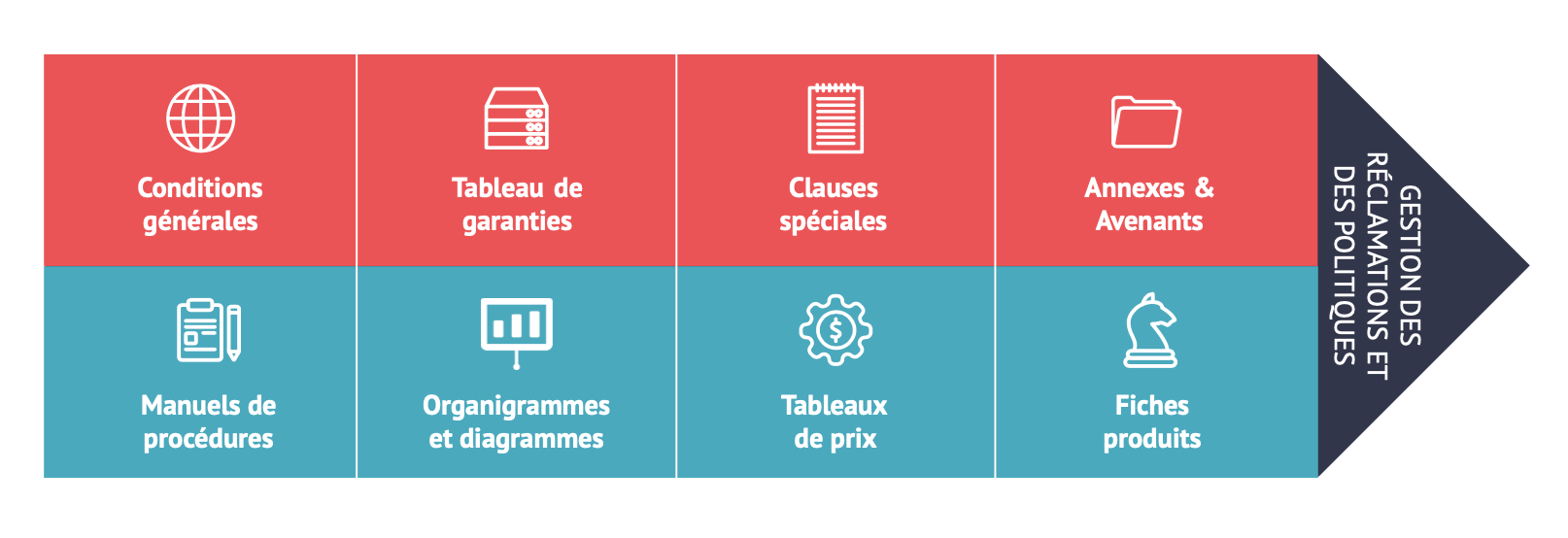

An insurance contract is highly complex, given its components:

- The contracting parties: First and foremost, the insurance contract clearly identifies the parties involved, namely the insurer and the insured. Contact details for each party, including their name, address and other relevant information, are usually included.

- General conditions: Insurance contracts include general conditions that apply to the entire policy.

- Clauses: Various clauses define the conditions of coverage. They define the risks covered, exclusions, deductibles, liability limits, premiums, payment terms, claim deadlines, and so on.

- Premium: Premium payment terms are generally specified in the insurance contract. It includes payment frequency and accepted payment methods.

- Guarantees: Guarantees are the insurer’s commitments regarding the risks covered by the insurance contract. They define what is insured and under what circumstances the insurer will pay compensation to the insured in the event of a claim.

- Exclusions: Exclusions are situations or events for which the insurer does not offer coverage. They are usually explicitly stated in the insurance contract. Exclusions may vary depending on the type of insurance and the terms of the contract.

- Appendix: Appendix are modifications or additions to the insurance contract that are agreed between the insurer and the insured after the initial policy has been taken out. They can be used to adjust coverage, modify terms or add beneficiaries, for example.

Generalist LLMs are unable to reason about the complex documents associated with the life of a contract and the management of claims/reimbursements because of their limited window of context and their lack of specialization in the insurance industry’s business logic.

How does Spellz solve the problem?

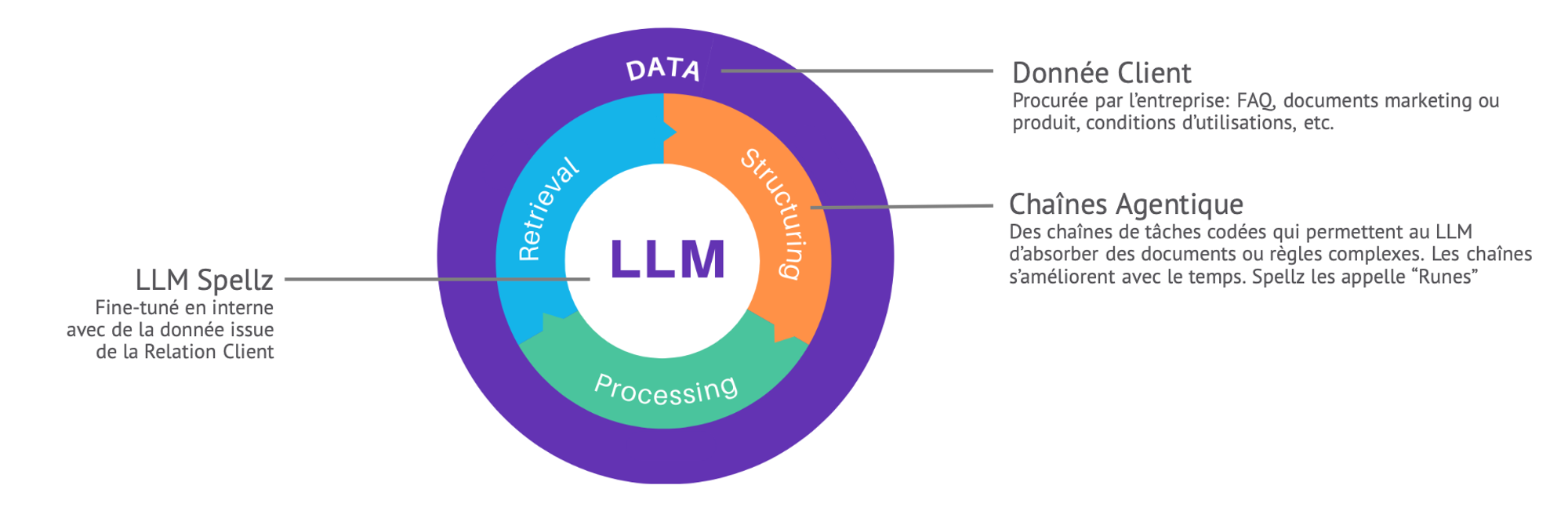

To overcome the limitations of the context window, Spellz opts for a new approach to RAG architecture. It pre-selects the relevant elements of contractual documents and presents them to LLM Spellz according to a chain of software steps that reproduces the customer’s business process (the steps of a flowchart, for example) and also the way a human brain goes through this process. The LLM is only called upon to reason when necessary, it is called upon several times for a given request, and it reasons on different elements depending on its position in the process. This translates into business logic-compliant behavior and an excellent computation cost/performance ratio.

Are you about to launch a generative AI development project?

Talk with us about it! ⬇️